In the world of finance, understanding a company’s ability to generate and distribute profits to its shareholders is crucial for investors. One of the key indicators used to gauge this is Free Cash Flow to Equity (FCFE). Think of FCFE as the lifeblood of a business, the cash that remains after all expenses, reinvestment needs, and debt obligations have been satisfied, which is then available to shareholders. It is often considered a more precise reflection of a company’s financial health than other measures, such as earnings or net income, because it considers actual cash flow and not just accounting profits.

What is Free Cash Flow to Equity (FCFE)?

Just as a gardener tends to their plants, ensuring they have enough water and nutrients to grow, a company must manage its cash flow efficiently to ensure growth and profit distribution. FCFE represents the final product after a company has taken care of all its operational, capital, and financing needs. It tells shareholders what they can expect to receive after the company has taken care of its internal needs and debt commitments.

For those considering a career in finance or data analysis, especially through a data analyst course, understanding this financial metric is vital for evaluating business performance, particularly in sectors where cash flow is a priority, such as in real estate or energy companies.

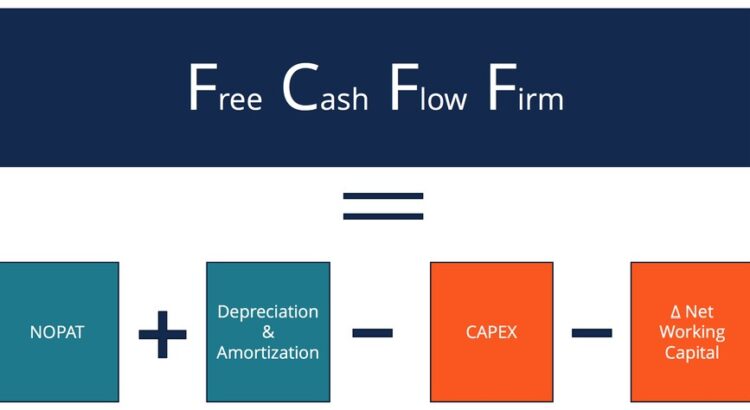

How FCFE is Calculated

The calculation of FCFE is relatively straightforward, but it requires a keen understanding of a company’s financial statements. Essentially, it is derived from the following formula:

FCFE=Net Income+Depreciation−Changes in Working Capital−Capital Expenditures+Net BorrowingFCFE = Net \, Income + Depreciation – Changes \, in \, Working \, Capital – Capital \, Expenditures + Net \, BorrowingFCFE=NetIncome+Depreciation−ChangesinWorkingCapital−CapitalExpenditures+NetBorrowing

- Net Income: The profit a company generates after all expenses.

- Depreciation: The reduction in value of the company’s assets, a non-cash charge.

- Changes in Working Capital: Adjustments for changes in operational assets and liabilities.

- Capital Expenditures: Investments made for future growth, such as purchasing new equipment or property.

- Net Borrowing: The amount of debt the company raises or repays.

Once these factors are calculated, they reveal the amount of cash that is available to equity holders, essentially the money that can be distributed as dividends or reinvested in the business.

Why FCFE is Important for Investors

For investors, especially those entering the finance or data analytics world through a data analytics course in Mumbai, understanding FCFE is critical. Unlike net income, which can be influenced by accounting manipulations or depreciation schedules, FCFE offers a clearer view of a company’s actual cash-generating capabilities. This makes it particularly valuable when comparing companies within capital-intensive industries or evaluating the long-term sustainability of dividend payments.

For instance, a company with strong FCFE can comfortably pay dividends to its shareholders, invest in growth opportunities, or reduce its debt. On the other hand, a company with poor FCFE may struggle to meet these obligations, which could affect shareholder returns and the company’s long-term viability.

Real-World Application of FCFE in Decision-Making

Let’s consider the example of a company in the technology sector. Imagine a startup that has seen significant growth, generating impressive revenues. However, it is still heavily investing in research and development, purchasing new technology, and expanding its operations. Despite showing a strong profit on paper, its FCFE might be low, as much of the revenue is reinvested back into the business. Investors who are focused on cash flow rather than just profits would be cautious, as the company may not have sufficient funds to pay out dividends or reduce its debt anytime soon.

In contrast, consider a mature manufacturing firm that operates in a stable market. Its capital expenditures are lower, and it has fewer opportunities for reinvestment. This results in a higher FCFE, which can be distributed to shareholders as dividends, or reinvested in a way that benefits long-term shareholder value.

The Role of FCFE in Valuation

FCFE is often used in valuation models, particularly in the discounted cash flow (DCF) model, to estimate the value of a company. By projecting future FCFE and discounting it to present value, analysts can determine whether a company is undervalued or overvalued in the market. This method provides a more accurate valuation of businesses with strong cash flows but low profits, or those that are growing rapidly and reinvesting most of their profits.

In this context, professionals who have completed a data analytics course in Mumbai can leverage their skills to analyze large financial datasets, extracting insights related to FCFE and using them to make more informed investment decisions. This deep understanding of cash flow analysis is crucial for roles in equity research, portfolio management, and corporate finance.

Conclusion

In summary, Free Cash Flow to Equity (FCFE) is a fundamental financial metric that reveals the true cash available to equity holders after all necessary business expenses and debt obligations are settled. By understanding and analyzing FCFE, investors can gain a clearer picture of a company’s ability to generate cash, distribute dividends, and grow sustainably. For those entering fields related to finance, corporate analysis, or data analytics, mastering FCFE analysis offers a valuable skill set that can enhance career prospects and provide deeper insights into business performance.

By exploring this metric, those pursuing a data analyst course or a data analytics course in Mumbai will not only understand how companies generate value but also be better equipped to analyze financial health from a more grounded, data-driven perspective.

Business Name: ExcelR- Data Science, Data Analytics, Business Analyst Course Training Mumbai

Address: Unit no. 302, 03rd Floor, Ashok Premises, Old Nagardas Rd, Nicolas Wadi Rd, Mogra Village, Gundavali Gaothan, Andheri E, Mumbai, Maharashtra 400069, Phone: 09108238354, Email: enquiry@excelr.com.